While it is true that the economy of the United States is indeed growing, there are still a lot of Americans struggling financially. As such, the promised tax relief by US President Donald J. Trump is crucial for millions as the new tax season has started. The White House officially announced the largest tax refund in the nation’s history and there is professional feedback to support it.

To put things in perspective, posted below is an excerpt from the White House announcement. Some parts in boldface…

As tax season kicks off, millions of Americans are poised to receive significantly larger tax refunds thanks to President Donald J. Trump’s landmark Working Families Tax Cuts Act — which every Democrat in Congress opposed.

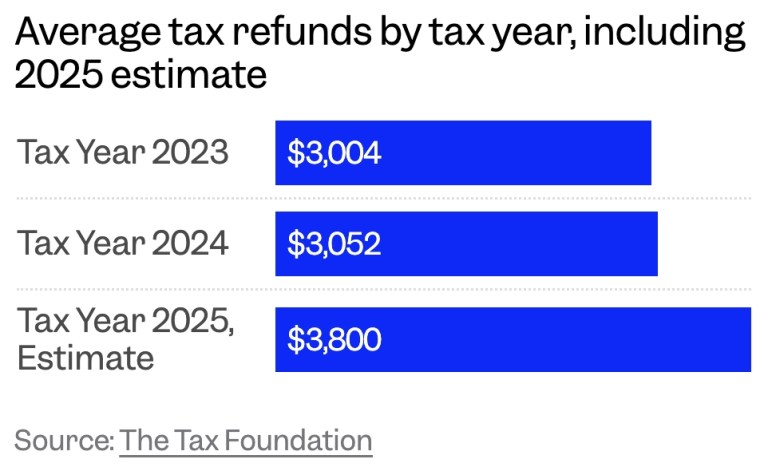

The historic legislation is delivering the biggest tax refund season ever, with average refunds projected to rise by $1,000 or more this year due to its transformative policies.

Economists and financial experts agree — 2026 will mark an unprecedented year for tax refunds:

USA TODAY: “The average refund in 2025 was $2,939, IRS data showed. This year, refunds could be as much as 30% more due to new provisions from President Donald Trump’s mega tax and spending bill, according to James Knightley, chief international economist at Dutch bank ING.”

CBS News: “Many Americans could see heftier tax refunds next year when they file their 2025 tax returns, largely due to new provisions enacted through the Republicans’ ‘one big, beautiful bill’ act that are retroactive to the start of the current year, according to an analysis from Oxford Economics. Total taxpayer savings could amount to an additional $50 billion through bigger tax refunds or a cut in their 2026 taxes…A $50 billion boost in tax refunds would represent an 18% increase from the $275 billion in refunds the IRS sent this year to nearly 94 million taxpayers who overpaid on their 2024 federal tax returns.”

The Wall Street Journal: “Refunds on average are expected to come in $1,000 higher than usual this year, according to a study by investment firm Piper Sandler.”

Business Insider: “The Tax Foundation estimates that the average tax refund will grow from $3,052 in 2024 to $3,800 for tax year 2025. Depending on your income and circumstances, you might get even more back.”

CNBC: “Tax experts and analysts have agreed that many filers will see bigger refunds… ‘Overall, we’re expecting these changes to increase refunds by 15% to 20% on average,’ Heather Berger, a U.S. economist with Morgan Stanley said…”

President Trump’s Working Families Tax Cuts Act provides broad-based tax relief for hardworking Americans, with the average taxpayer expected to see nearly $4,000 in total tax savings in 2026. Key provisions of the bill include No Tax on Tips, No Tax on Overtime, No Tax on Social Security, a deduction for auto loan interest on Made-in-America vehicles, and much more — putting more money back in the pockets of families, workers, and seniors.

For details about the One Big Beautiful Bill (OBBB) and the Working Families Tax Cuts, click here and here.

Let me end this piece by asking you readers: What is your reaction to this development? Do you think this new tax refund season will be very helpful to Americans who are struggling with making ends meet? Have you paid close attention to the details within the Working Families Tax Cuts and the One Big Beautiful Bill already? How many families in your local community have been anticipating the new tax refunds from the Trump administration? Do you think the new tax refunds will be able to boost gross domestic product (GDP) growth to 5% this year?

You may answer in the comments below. If you prefer to answer privately, you may do so by sending me a direct message online.

+++++

Thank you for reading. If you find this article engaging, please click the like button below, share this article to others and also please consider making a donation to support my publishing. If you are looking for a copywriter to create content for your special project or business, check out my services and my portfolio. Feel free to contact me with a private message. Also please feel free to visit my Facebook page Author Carlo Carrasco and follow me on Twitter at @HavenorFantasy as well as on Tumblr at https://carlocarrasco.tumblr.com/ and on Instagram athttps://www.instagram.com/authorcarlocarrasco